Introduction

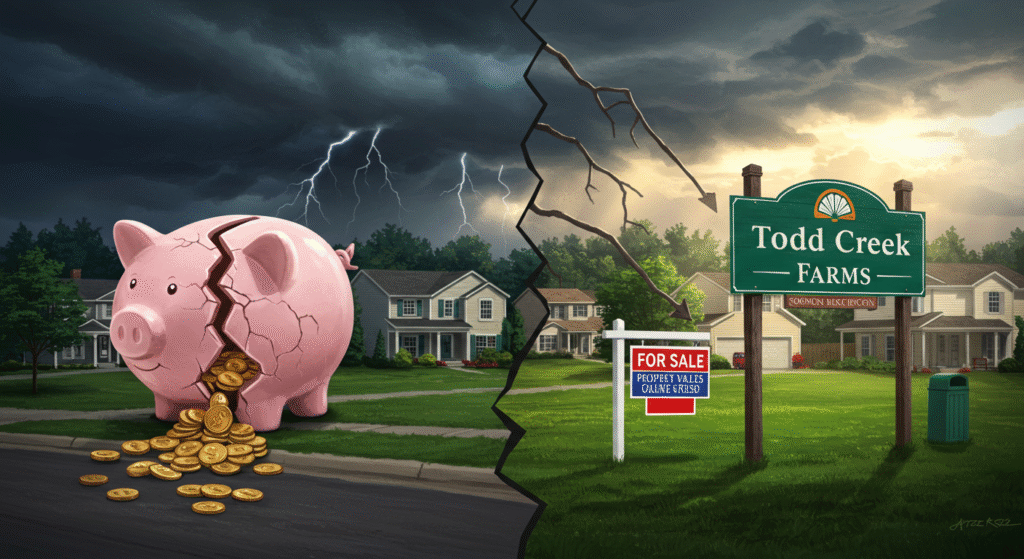

Picture living in a pretty neighborhood with open fields, walking paths, and friendly neighbors. That’s what Todd Creek Farms in Brighton, Colorado, is supposed to be. But right now, many homeowners are upset. They’re dealing with fights, money problems, and a big lawsuit. The homeowners association (HOA) filed for Chapter 11 bankruptcy in July 2025. Also, 21 homeowners are suing the HOA board, saying it took secret money from a landscaping company. This has everyone worried about what happens next.

I’m Orland Howell, and I’ve spent four years writing about lawsuits like this. I work with law firms and homeowners to make hard legal stuff easy to understand. I’ve seen how small HOA problems, like board choices or spending, can turn into big trouble. These issues can raise your fees, lower your home’s value, and make life stressful. This article explains the Todd Creek Farms case in simple words. We’ll talk about the HOA, how the problems started, the lawsuit’s main points, the bankruptcy, and what you can do if you live there. My goal is to help you feel informed and ready.

Todd Creek Farms is a fancy area with 370 homes on 750 acres. It’s west of Brighton in Adams County, near Denver. People love the country feel with city access. Since 2023, about 5% of homeowners have been suing the board. They say the board broke rules and mishandled money. The bankruptcy has paused the lawsuit. From my work on many HOA cases, I know trust is everything. When it’s gone, fights start, and courts get involved. Let’s look at the details.

What Is the Todd Creek Farms HOA?

First, let’s understand the HOA. A homeowners association is like the manager of the neighborhood. It collects money from homeowners every month to take care of shared things like paths, parks, and lawns. The Todd Creek Farms HOA has five board members who make decisions. Jason Pardikes has been the president since around 2020. The board says it works hard to keep the area nice. For example, it has shared money from old oil and gas deals with homeowners.

But some homeowners think the board hides things. Colorado law says HOAs must be honest and open. They have to follow the neighborhood’s rules, called bylaws, and share money plans with everyone. If they don’t, homeowners can sue. I’ve written about HOAs for four years, and I’ve seen that trust comes from clear talks and fair choices. When boards act alone, problems grow. At Todd Creek Farms, this lost trust led to a big lawsuit.

The community was built for people who want a quiet life near Denver. Homes cost a lot, lots are big, and open spaces look great. The HOA keeps things nice to protect home values. With 370 homes, even small mistakes cost everyone. Fees go up, and people feel it. This lawsuit shows why homeowners need to stay active.

How the Trouble Started

Big fights don’t happen all at once. At Todd Creek Farms, problems grew slowly. In late 2022, two board members quit. The three left, including Pardikes, picked each other to fill the empty spots. This let Pardikes stay in charge longer than allowed. Homeowners said this broke the bylaws. They felt the board cheated to keep power.

Then, homeowners asked for records about money and contracts. The board took too long to share them. Colorado law says they must give these papers within 10 days. The delays made people mad. They started a group to push for change. By early 2023, new rule changes upset more homeowners. Some said the board made these changes without enough votes from the community.

Meetings got loud and angry. People sent lots of emails. One homeowner, Edie Apke, later joined the lawsuit. She said, “I felt things were not right.” I’ve covered HOA fights for years, and I see this often. Early problems, like board changes or hidden records, lead to lawsuits. Homeowners pay the fees, so they want a say. When ignored, they fight back.

Things got worse with stress and even threats. Some reports mentioned death threats in past fights. The board says it fixed money problems and shared oil cash to help. But many felt it wasn’t enough. The lawsuit started in 2023 and became a big deal.

The Lawsuit: What It’s About

This lawsuit is called “derivative.” That means a few homeowners sue for everyone to protect the HOA’s interests. Lawyer Peter Towsky from Robinson & Henry leads it for 21 homeowners. More could join later. The lawsuit is against the HOA, its board, Method Landscaping, and Pardikes’ wife.

Here are the main issues in simple words:

- Wrong Board Changes: In 2022, the board’s seat swap broke the bylaws. It let Pardikes stay in charge without a fair vote.

- Hiding Records: The board didn’t share money records quickly, which breaks Colorado law.

- Landscaping Kickbacks: The biggest problem. In 2020, the HOA hired Method Landscaping to fix trails for $27,000. But the costs grew to $215,000-$219,000. Homeowners say the board added extra work without asking for new bids. They believe Pardikes had secret ties to Method and got paid under the table.

Towsky says Pardikes may have gained $100,000 or more. The Adams County Sheriff looked into theft claims against him. The board says it did nothing wrong. Pardikes claims audits prove everything was fair. He calls the lawsuit an attack by a few upset people.

I’ve worked on similar cases, and kickback claims are a big deal. They break the board’s duty to be honest, called “fiduciary duty.” Landscaping fights happen a lot in HOAs because they cost so much. Picking a friend’s company without bids hurts trust. Homeowners here asked for bank records to prove the payments, but the bankruptcy stopped that for now.

The Landscaping Problem

Let’s talk more about the landscaping issue. In 2020, the HOA needed to fix trails worn out from use. They hired Method Landscaping for $27,000 to do simple repairs. That sounded fair.

But the costs jumped to $215,000 for trails, plants, and more. The lawsuit says the board added work without getting new bids or homeowner approval. They didn’t check if prices were fair. Court papers say Pardikes knows Method’s owners. A sheriff’s investigation linked him to the company. Homeowners wanted bank records to see where the money went. Pardikes says he has no ownership in Method.

The board claims all the work was needed and approved. They show contracts and audits to back this up. But the homeowners say hiding ties to Method broke the rules. Colorado law says boards must tell everyone about connections to companies they hire.

I’ve written about many landscaping problems in HOAs. Boards rush to fix things like trails, but without clear steps, costs grow fast. The extra $188,000 could have paid for lights, a pool, or lower fees. Instead, it caused this fight. Being open about bids and ties could have stopped this.

What Chapter 11 Bankruptcy Means

On July 15, 2025, the HOA filed for Chapter 11 bankruptcy in U.S. Bankruptcy Court. Judge Kimberley H. Tyson is in charge. The case number is 1:2025bk14385. Chapter 11 lets the HOA reorganize its debts while keeping daily work going. It stops big payments, like lawsuit costs, for now.

Pardikes said this was to “stop the bleeding.” The lawsuit has cost over $900,000 so far. Earlier fights cost $100,000 over two years. The board warned that continuing could mean extra fees for all homeowners.

The lawsuit is paused because of the bankruptcy. The court will decide if it can go on. Towsky says it’s rare for an HOA to file Chapter 11. He wonders if it’s a trick to avoid blame. Pardikes says it’s to keep the community stable.

In my work, I’ve seen bankruptcy used as a shield in HOA fights. It gives the board time but stresses homeowners. Fees might go up to pay debts, and selling homes could get harder because of the drama.

How This Affects You

If you live in Todd Creek Farms, this hits you directly. Here’s how:

- Your Money: Monthly fees pay for things like trash pickup or snow clearing. Bankruptcy means less money, so these services might slow down. You could face extra fees of hundreds of dollars.

- Home Value: People don’t want to buy homes in troubled HOAs. Fancy areas like this lose value fast. Some reports say home prices could drop 5-10%.

- Community Stress: Neighbors are split. Some support the board; others back the lawsuit. Meetings are tense. Apke said it’s “frustrating and aggravating.” Kids play, but parents worry about money.

The 21 homeowners suing want change. Towsky says it’s about making the board accountable. But all 370 homes feel the effects. I’ve seen cases like this split communities for years. Oil and gas money helps with fees now, but these fights use up funds. Stay alert to protect your peace.

Your Rights as a Homeowner

You have rights. Colorado law, like HB 21-1122, protects you. Here’s what you can do:

Read the Bylaws

The bylaws are the HOA’s rules. They explain what the board can do and how money is spent. Check them to find problems early.

Ask for Records

You can ask for budgets or contracts. The board must give them to you in 10 days. If they don’t, tell the Colorado Division of Real Estate.

Join with Neighbors

Talk to others. The homeowners suing started with emails. Now they share court papers on a website. Stick to facts, not rumors.

Vote in Elections

You choose the board through elections. Push for fair ones. A special election is happening now to change the board.

Watch the Bankruptcy

Check court updates online with case number 1:2025bk14385. This shows if fees or rulings change.

I always tell homeowners: Act early. Go to meetings and ask questions. It can stop bigger problems.

The Legal Side: Board Duties

The board has a “fiduciary duty” to be honest, careful, and fair. They can’t make secret deals.

The lawsuit says the board failed. Hiding ties to Method isn’t honest. Spending $215,000 without bids isn’t careful. Colorado law says boards must get bids for big jobs and tell about any connections.

If the court agrees, the board might have to pay back money or leave. Their audits say everything is fine, but the court decides. Pardikes plans to sue the sheriff over the investigation.

What Might Happen Next

This case could go a few ways:

- Agreement: Both sides settle. The board might quit or pay back money, and the lawsuit ends.

- Homeowners Win: The court finds kickbacks. The board pays, and a new election happens.

- Bankruptcy Stops It: The lawsuit could end if the bankruptcy is seen as fair. Homeowners might appeal.

- Long Fight: The case could last years, raising fees for everyone.

Towsky thinks the bankruptcy is to avoid blame. Pardikes says it protects the community. Most cases settle to save money, so keep an eye on updates.

Tips to Protect Yourself in Any HOA

From my four years of work, here are simple ways to stay safe:

- Get Involved: Join the board or a committee to see how money is spent.

- Check Money Plans: Look at yearly budgets. Ask about strange costs.

- Get Insurance: Some HOAs have coverage for legal fights. Check for D&O policies.

- Try Talking First: Settling outside court is cheaper. Colorado likes this approach.

- Find a Lawyer: HOA experts like Towsky can spot problems fast.

These steps keep trust strong. They might have stopped this at Todd Creek Farms.

Conclusion

The Todd Creek Farms lawsuit shows how HOA problems hurt everyone. From board changes to $900,000 in legal fees, it’s a mess. Kickback claims and bankruptcy make things worse. Homeowners want answers; the board wants calm. As Orland Howell, I write to help you with clear facts from public sources. Stay updated through the homeowners’ website or court records. Check Colorado HOA resources for help. Your home deserves fairness.

Disclaimer: This article shares basic information about the Todd Creek Farms HOA lawsuit. It is not legal advice. Talk to a lawyer for your own situation. All facts come from public records and news reports. Facts are correct as of September 25, 2025, based on public records and may change.

Explore More:

Listeria Ice Cream Lawsuit: 2025 Recalls, Who’s to Blame, and How to Get Paid

Branson Nantucket Lawsuit — January 27, 2025 Appeal Upheld: What Timeshare Owners Need to Know

Orland Howell is a seasoned content writer with four years of deep expertise in crafting compelling and informative content about lawsuit settlements. With a keen understanding of legal nuances and a talent for translating complex topics into clear, engaging narratives, Orland helps law firms, legal professionals, and clients communicate effectively. His work spans blog posts, articles, whitepapers, and website content, all designed to educate, inform, and drive results. Passionate about empowering audiences with knowledge, Orland combines precision, creativity, and industry insight to deliver content that resonates and builds trust.