Why This Lawsuit Is a Big Deal

When you invest money, you trust it will grow and give you income. But what if that trust breaks? The Ashcroft Capital lawsuit, called the Cautero case, is a big problem in 2025 for people who invest in apartment buildings. On February 12, 2025, 12 investors started this lawsuit in a New Jersey court. They allege Ashcroft Capital misled them, leading to losses of more than $18 million. The leader of the group, Anthony Cautero, says the company made big promises but hid problems.

Ashcroft Capital is a Texas company started in 2015 by Joe Fairless and Frank Roessler. They buy old apartment buildings, fix them up, and rent them out to make money. They manage over $2 billion in properties and thousands of apartments, promising investors easy profits. But this lawsuit is causing worry.

My name is Orland Howell. I’ve written about lawsuits for four years, and I know it’s scary when investments fail. This article explains the case in very simple words. We’ll talk about who Ashcroft is, why the lawsuit started, what the investors say, the proof, the money lost, and what this means for apartment investors. Let’s make it super clear.

Who Is Ashcroft Capital?

Let’s first understand Ashcroft Capital.

Ashcroft Capital lets regular people invest in big apartment buildings without doing the work. Founders Joe Fairless and Frank Roessler used their real estate podcasts and books to find investors. They buy older apartments in places like Texas, Georgia, and Florida. Their plan is to buy cheap, fix the buildings, charge higher rent, and sell for a profit.

By 2022, Ashcroft had collected lots of money from rich investors who qualify for private deals. They managed over 12,000 apartments and promised 4-6% income each year, plus extra money when buildings were sold. Their marketing materials emphasized ease of investing and attractive returns.

But in 2021, things got tough. Interest rates went up, so loans cost more. Fixing buildings was more expensive than planned, and rents didn’t grow much. Ashcroft stopped paying some investors and asked for more money—called capital calls—to keep things going. This made people mad, and they shared complaints online, like on Reddit, about unclear information and broken promises.

These problems led to the 2025 lawsuit. It shows that even big companies can have trouble, and how they handle it is important.

Why Did the Cautero Case Start?

The lawsuit is called Cautero v. Ashcroft Legacy Funds, LLC et al. (Case No. 2:25-cv-01212). It was filed in a New Jersey court because many investors live there, and the deals covered different states.

Anthony Cautero, the main person suing, is a rich investor who put a lot of money into Ashcroft’s deals. He and 11 others say the company’s exciting ads pulled them in but didn’t warn them when things went wrong. They claim Ashcroft violated investor protection laws.

Here’s what happened, step by step:

- 2015-2021: Good Years – Ashcroft gets lots of money and buys apartments. Investors get updates and some payments.

- 2022-2023: Hard Times – Higher interest rates make loans expensive. Repairs cost more. Ashcroft stops some payments and asks for extra money, up to 19.7% of what investors gave.

- Early 2024: People Get Mad – Investors complain about unclear reports and no plans. Investor discussions on platforms like Reddit expressed frustration about delayed payments.

- January 2025: Problems Grow – Payments are still missing. Investors team up.

- February 12, 2025: Lawsuit Starts – The 12 investors sue, asking for over $18 million for their losses.

- March 2025: Ashcroft Answers – The company says the claims are wrong. CEO Joe Fairless says they shared all risks, and market problems caused the issues.

- July 2025: Court Moves On – The judge says Ashcroft must share profit data. Both sides are still sharing proof.

As of September 2025, the case is still in the proof-sharing stage. There’s no trial date, but they might settle soon. Lawsuits like this take time, which worries investors.

What Are the Investors Complaining About?

The lawsuit has four main complaints. Let’s explain them in easy words.

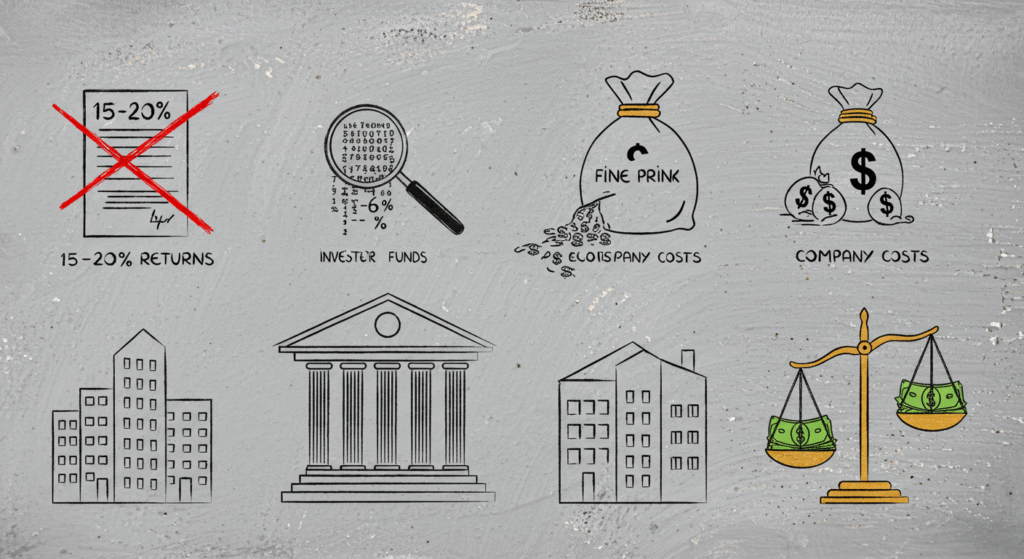

1. Big Promises That Weren’t True

According to the lawsuit, investors claim Ashcroft promoted high potential returns (15–20%), while actual distributions were lower (around 4–6%). Ads, emails, and talks showed only the best possibilities and didn’t say how rising interest rates could lower profits.

2. Hiding Problems

The lawsuit says Ashcroft didn’t warn about risks, like expensive repairs or empty apartments. The papers investors signed, called Private Placement Memorandums (PPMs), had some warnings in tiny print, but big risks weren’t clear.

3. Using Money the Wrong Way

Investors say Ashcroft used their money for things not in the plan, like extra company costs or perks for its leaders. The company kept charging fees, like for managing apartments, even when the buildings lost money. This helped Ashcroft more than the investors.

4. Not Caring About Investors

The investors allege company leaders breached their fiduciary duties by prioritizing company profits over investors. They made choices that helped the company make money instead of helping investors, breaking laws that say they must be honest.

Ashcroft says these complaints are wrong. They say all risks were in the signed papers, projections aren’t promises, and market problems caused the trouble. They haven’t said they did anything wrong.

These issues happen in other real estate lawsuits, but the $18 million claim makes this case important.

What Proof Is There?

Lawsuits need proof to win. In the Cautero case, the proof-sharing stage has shown some big things. Here’s what we know from court papers.

First, Court filings reference emails suggesting Ashcroft anticipated 20–30% higher repair costs but did not immediately disclose this to investors. A 2022 email talks about “hopeful planning” to get more investors.

Second, profit records are being checked. In July 2025, the court told Ashcroft to share data from 2021-2023 deals. Early records show lower profits than what investors were told.

Third, a former Ashcroft worker said the team wasn’t sure about their plans but kept going to raise money. This makes the claims feel more real.

Fourth, records show Ashcroft charged millions in fees while stopping investor payments during bad times.

Ashcroft says this proof is misunderstood and blames market issues, like higher interest rates in 2023. They’ve shared some papers but asked for more time, which led to a hearing in August 2025. More proof, like statements from leaders, might come soon.

From my four years of writing about lawsuits, I know proof like emails can be strong in court. But it’s early, and Ashcroft might fight back.

Money Lost: How It Hurts People

The $18 million claim is about real people losing money. The 12 investors each put in thousands or hundreds of thousands of dollars. One, maybe Cautero, invested over $500,000 in several deals.

The losses hurt in different ways:

- Lost Money: Some deals haven’t paid since 2023. Investors had to add up to 20% more money to keep things going. The total loss is $18 million, but it could grow if more people join.

- Missed Other Investments: Money stuck in these deals could have gone to better options. One person on Reddit said, “I could have chosen safer investments.”

- Feeling Upset: Investors feel tricked. Some worry about their future, like retirement, based on online posts.

Not all Ashcroft investors have problems. Newer deals are still paying, and the company is running. But for those in older deals, it’s a tough wait. Based on past real estate lawsuit settlements, investors in similar cases have recovered between 50–70% after legal fees, though outcomes in this case remain uncertain, based on other cases.

How Ashcroft Is Fighting Back

Ashcroft is defending itself strongly. In March 2025, they said, “We don’t agree with the claims and work honestly.” Their points are:

- All risks were in the papers investors signed.

- Profit projections aren’t promises, and markets change.

- Fees are normal, and stopping payments was to save future value.

- No money was used wrongly; extra funds went to needed repairs.

Ashcroft has stopped some work, like raising new money, to focus on the lawsuit. They tell investors their properties are safe. Experts say Ashcroft’s lawyers are good and might try to throw out parts of the case. A settlement is likely because trials cost a lot.

Where the Case Is Now in September 2025

In September 2025, the case is in the proof-sharing stage. A big step was the July 2025 court order for Ashcroft to share profit data. Statements from leaders are expected in the fall, and settlement talks might start by the end of 2025.

The lawsuit isn’t a group case yet, but more investors could join, possibly raising claims to $75 million. Other similar cases have led to government checks, so regulators might look into this.

What This Means for Apartment Investors: How to Stay Safe

This case isn’t just about Ashcroft—it’s a warning for everyone investing in apartments. Here’s what it means and how to protect yourself.

How It Changes Things

- More Rules: The government might make companies explain risks better.

- Less Trust: Apartment deals need trust. This case might make people more careful, slowing new deals.

- Different Market: Apartment deals might cost more as companies add protections, but this could remove bad companies.

Tips for Investors

If you’re with Ashcroft or similar companies:

- Check your papers and updates for anything unclear.

- Join investor calls and ask for clear money details.

- Put your money in different places, not just one deal.

- Talk to a lawyer or advisor if you’re worried.

For new investments:

- Look up the company’s past, not just their ads.

- Ask what happens if interest rates go up by 2%.

- Get an outside expert to check the company’s money.

In my four years of writing about lawsuits, I’ve seen cases like this make things better. For example, a 2014 lawsuit against Inland American REIT gave $60 million back to investors, showing fairness can happen.

Conclusion: Trusting Again After Trouble

The Cautero case shows the risks of investing in apartments. With $18 million at stake, new proof, and lessons for everyone, it’s a big moment. Ashcroft might get through this, but the real win is a fairer industry. As Orland Howell, I’ve helped people understand tough cases with simple words. Knowledge keeps you safe. Stay informed, ask questions, and invest carefully. If this case affects you, talk to a professional. The future of real estate can be good for those who learn from today.

Disclaimer: This article, written by Orland Howell, provides general information about the 2025 Ashcroft Capital lawsuit (Cautero v. Ashcroft Legacy Funds, LLC et al.) based on publicly available court documents and reports as of September 24, 2025. It is not legal or financial advice. The information is for educational purposes only and should not be used to make investment decisions. Always consult a qualified lawyer or financial advisor before acting on any investment or legal matter. While every effort has been made to ensure accuracy, details in ongoing lawsuits may change. Orland Howell and the publisher are not responsible for any errors or outcomes from using this information.

Explore More:

Subaru Windshield Settlement: Easy Guide to Get Your Money Back

Aseltine v BANA Class Settlement: Your Easy Guide for 2025

Bruin v Bana Class Settlement: Your Easy Guide to Compensation

Orland Howell is a seasoned content writer with four years of deep expertise in crafting compelling and informative content about lawsuit settlements. With a keen understanding of legal nuances and a talent for translating complex topics into clear, engaging narratives, Orland helps law firms, legal professionals, and clients communicate effectively. His work spans blog posts, articles, whitepapers, and website content, all designed to educate, inform, and drive results. Passionate about empowering audiences with knowledge, Orland combines precision, creativity, and industry insight to deliver content that resonates and builds trust.